Exhibit 99.2

KONTOOR BRANDS, INC. SEPARATION UPDATE: SUPPLEMENTAL INFORMATION APRIL 2019

Exhibit 99.2

KONTOOR BRANDS, INC. SEPARATION UPDATE: SUPPLEMENTAL INFORMATION APRIL 2019

FORWARD-LOOKING STATEMENTS Certain written and oral statements included in this presentation are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are made based on our expectations and beliefs concerning future events impacting VF and Kontoor Brands and therefore involve several risks and uncertainties that are difficult to predict. You can identify these statements by the fact that they use words such as “will,” “anticipate,” “estimate,” “expect,” “should,” “may,” “believe,” “appear,” “intend,” “plan,” “assume,” “seek,” “forecast,” and other words and terms of similar meaning or use of future dates. We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements. Potential risks and uncertainties that could cause the actual results of operations or financial condition of VF and Kontoor Brands to differ materially from those expressed or implied by forward-looking statements in this release include, but are not limited to: foreign currency fluctuations; the level of consumer demand for apparel, footwear and accessories; disruption to distribution systems; reliance on a small number of large customers; the financial strength of customers; fluctuations in the price, availability and quality of raw materials and contracted products; disruption and volatility in the global capital and credit markets; response to changing fashion trends, evolving consumer preferences and changing patterns of consumer behavior, intense competition from online retailers, manufacturing and product innovation; increasing pressure on margins; ability to implement business strategy; ability to grow international and direct-to-consumer businesses; each company and its customers’ and vendors’ ability to maintain the strength and security of information technology systems; stability of manufacturing facilities and foreign suppliers; continued use by suppliers of ethical business practices; ability to accurately forecast demand for products; continuity of members of management; ability to protect trademarks and other intellectual property rights; possible goodwill and other asset impairment; maintenance by licensees and distributors of the value of each company’s brands; ability to execute and integrate acquisitions; changes in tax laws and liabilities; legal, regulatory, political and economic risks; adverse or unexpected weather conditions; and risks associated with the proposed spin-off of the Jeanswear business and VF’s ability to realize the expected benefit of the spin-off. More information on potential factors that could affect VF’s financial results is included from time to time in VF’s public reports filed with the Securities and Exchange Commission, including VF’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and more information on potential factors that could affect Kontoor Brands’ financial results is included in its Registration Statement on Form 10 filed with the Securities and Exchange Commission. The forward-looking statements in this presentation speak only as of the date of this presentation. Factors or events that could cause actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. Unless required by law, we undertake no obligation to update publicly any forward-looking statements as a result of new information, future events or otherwise.

DISCLAIMER Non-GAAP Financial Measures Financial information contained in this presentation includes certain financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting policies in the United States of America (GAAP), which include or exclude certain items from the most directly comparable GAAP financial measure. These non-GAAP measures differ from reported GAAP measures and are intended to illustrate what management believes are relevant period-over-period comparisons and are helpful to investors as an additional tool for further understanding and assessing VF and Kontoor’s expected ongoing operating performance. Such non-GAAP measures should be viewed in addition to, and not as an alternative for, reported results under GAAP. Please refer to the appendix to this presentation for definitions of the non-GAAP financial measures used herein and reconciliations of each non-GAAP financial measure to the most directly comparable GAAP financial measure. Market Data Certain market and/or industry data used in this presentation were obtained from market research and publicly available information. Such information may include data obtained from sources believed to be reliable, however VF disclaims the accuracy and completeness of such information which is not guaranteed.

SEPARATION OVERVIEW AND TRANSACTION UPDATE

COMPELLING RATIONALE FOR A SEPARATION Enhances strategic and management focus Creates opportunity to focus investment on strategic priorities Provides flexibility to pursue independent strategies and paths to value creation Drives more efficient allocation of capital Aligns each company with its natural investor type

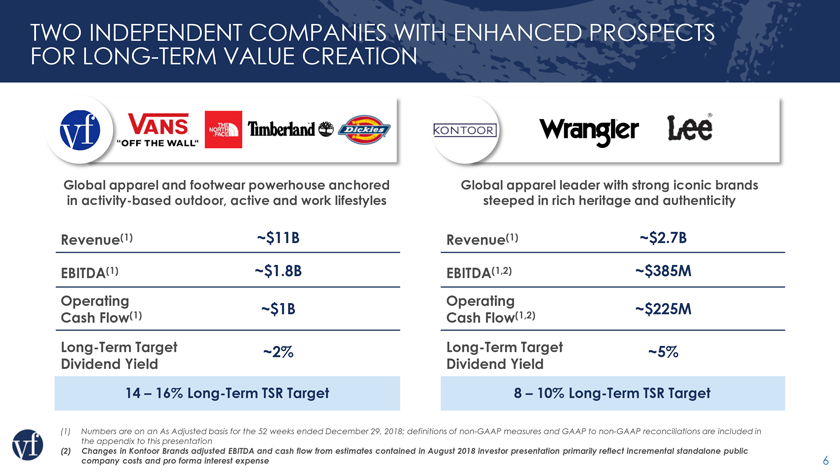

TWO INDEPENDENT COMPANIES WITH ENHANCED PROSPECTS FOR LONG-TERM VALUE CREATION Global apparel and footwear powerhouse anchored in activity-based outdoor, active and work lifestyles Revenue(1) ~$11B EBITDA(1) ~$1.8B Operating ~$1B Cash Flow(1) Long-Term Target ~2% Dividend Yield 14 – 16% Long-Term TSR Target Global apparel leader with strong iconic brands steeped in rich heritage and authenticity Revenue(1) ~$2.7B EBITDA(1,2) ~$385M Operating ~$225M Cash Flow(1,2) Long-Term Target ~5% Dividend Yield 8 – 10% Long-Term TSR Target (1) Numbers are on an As Adjusted basis for the 52 weeks ended December 29, 2018; definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation (2) Changes in Kontoor Brands adjusted EBITDA and cash flow from estimates contained in August 2018 investor presentation primarily reflect incremental standalone public company costs and pro forma interest expense 6

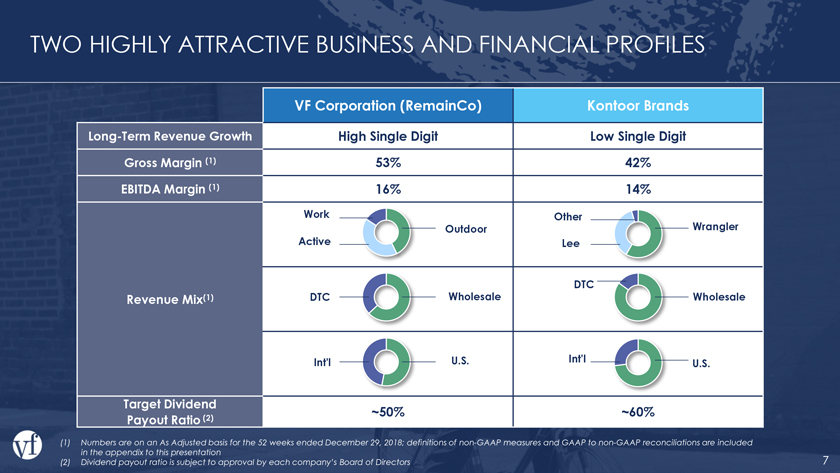

TWO HIGHLY ATTRACTIVE BUSINESS AND FINANCIAL PROFILES VF Corporation (RemainCo) Kontoor Brands Long-Term Revenue Growth High Single Digit Low Single Digit Gross Margin (1) 53% 42% EBITDA Margin (1) 16% 14% Work Other Outdoor Wrangler Active Lee DTC Revenue Mix(1) DTC Wholesale Wholesale Int’l U.S. Int’l U.S. Target Dividend (2) ~50% ~60% Payout Ratio (1) Numbers are on an As Adjusted basis for the 52 weeks ended December 29, 2018; definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation (2) Dividend payout ratio is subject to approval by each company’s Board of Directors 7

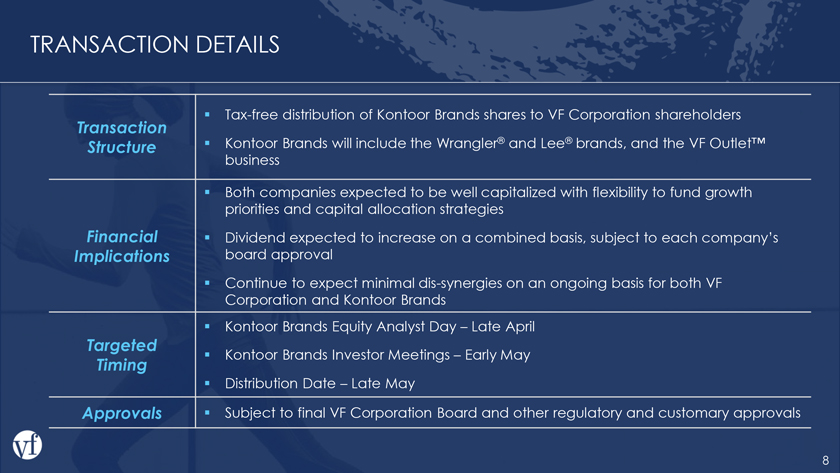

TRANSACTION DETAILS Tax-free distribution of Kontoor Brands shares to VF Corporation shareholders Transaction ® ® Structure Kontoor Brands will include the Wrangler and Lee brands, and the VF Outlet™ business Both companies expected to be well capitalized with flexibility to fund growth priorities and capital allocation strategies Financial Dividend expected to increase on a combined basis, subject to each company’s Implications board approval Continue to expect minimal dis-synergies on an ongoing basis for both VF Corporation and Kontoor Brands Kontoor Brands Equity Analyst Day – Late April Targeted Timing Kontoor Brands Investor Meetings – Early May Distribution Date – Late May Approvals Subject to final VF Corporation Board and other regulatory and customary approvals 8

VF CORPORATION (REMAINCO)

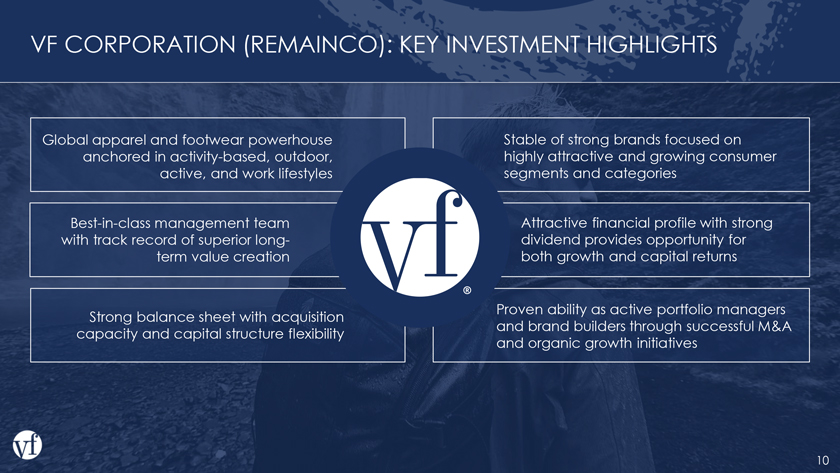

VF CORPORATION (REMAINCO): KEY INVESTMENT HIGHLIGHTS Global apparel and footwear powerhouse Stable of strong brands focused on anchored in activity-based, outdoor, highly attractive and growing consumer active, and work lifestyles segments and categories Best-in-class management team Attractive financial profile with strong with track record of superior long- dividend provides opportunity for term value creation both growth and capital returns Proven ability as active portfolio managers Strong balance sheet with acquisition and brand builders through successful M&A capacity and capital structure flexibility and organic growth initiatives 10

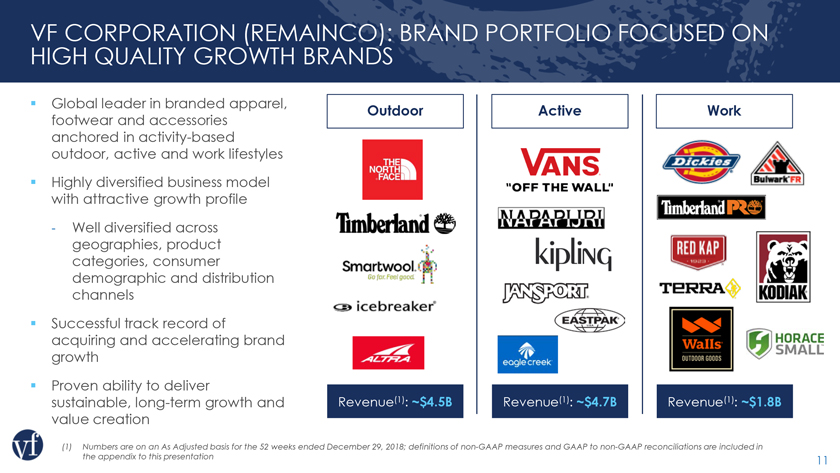

VF CORPORATION (REMAINCO): BRAND PORTFOLIO FOCUSED ON HIGH QUALITY GROWTH BRANDS Global leader in branded apparel, Outdoor Active Work footwear and accessories anchored in activity-based outdoor, active and work lifestyles Highly diversified business model with attractive growth profile—Well diversified across geographies, product categories, consumer demographic and distribution channels Successful track record of acquiring and accelerating brand growth Proven ability to deliver sustainable, long-term growth and Revenue(1): ~$4.5B Revenue(1): ~$4.7B Revenue(1): ~$1.8B value creation (1) Numbers are on an As Adjusted basis for the 52 weeks ended December 29, 2018; definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation 11

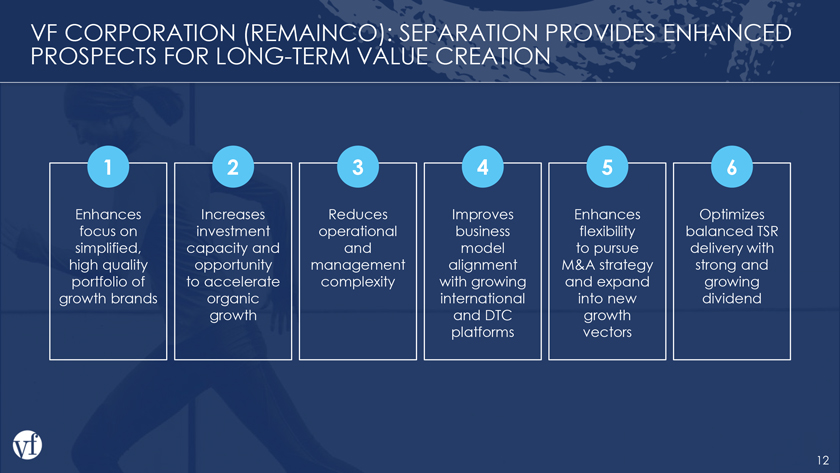

VF CORPORATION (REMAINCO): SEPARATION PROVIDES ENHANCED PROSPECTS FOR LONG-TERM VALUE CREATION 1 2 3 4 5 6 Enhances

Increases Reduces Improves Enhances Optimizes focus on investment operational business flexibility balanced TSR simplified, capacity and and model to pursue delivery with high quality opportunity management alignment M&A strategy strong and

portfolio of to accelerate complexity with growing and expand growing growth brands organic international into new dividend growth and DTC growth platforms vectors 12

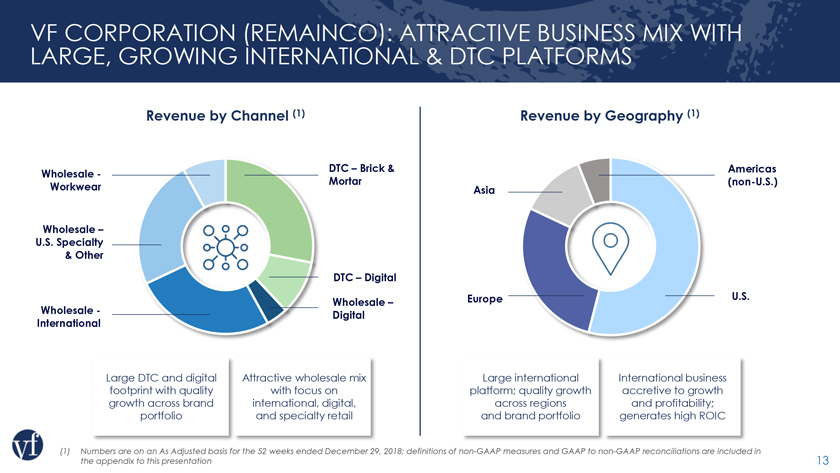

VF CORPORATION (REMAINCO): ATTRACTIVE BUSINESS MIX WITH LARGE, GROWING INTERNATIONAL & DTC PLATFORMS Revenue by Channel (1) Revenue by Geography (1) Wholesale—DTC – Brick & Americas Workwear Mortar (non-U.S.) Asia Wholesale –U.S. Specialty & Other DTC – Digital Wholesale – Europe U.S. Wholesale—Digital International Large DTC and digital Attractive wholesale mix Large international International business footprint with quality with focus on platform; quality growth accretive to growth growth across brand international, digital, across regions and profitability; portfolio and specialty retail and brand portfolio generates high ROIC (1) Numbers are on an As Adjusted basis for the 52 weeks ended December 29, 2018; definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation 13

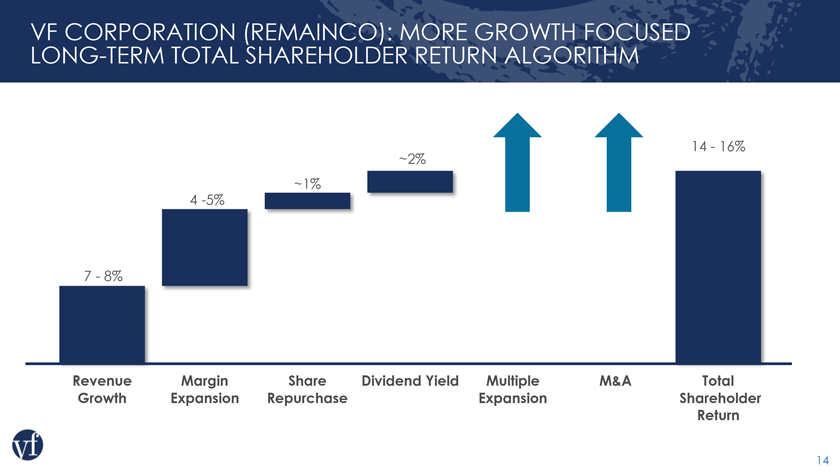

VF CORPORATION (REMAINCO): MORE GROWTH FOCUSED LONG-TERM TOTAL SHAREHOLDER RETURN ALGORITHM 14—16% ~2% ~1% 4 -5% 7—8% Revenue Margin Share Dividend Yield Multiple M&A Total Growth Expansion Repurchase Expansion Shareholder Return 14

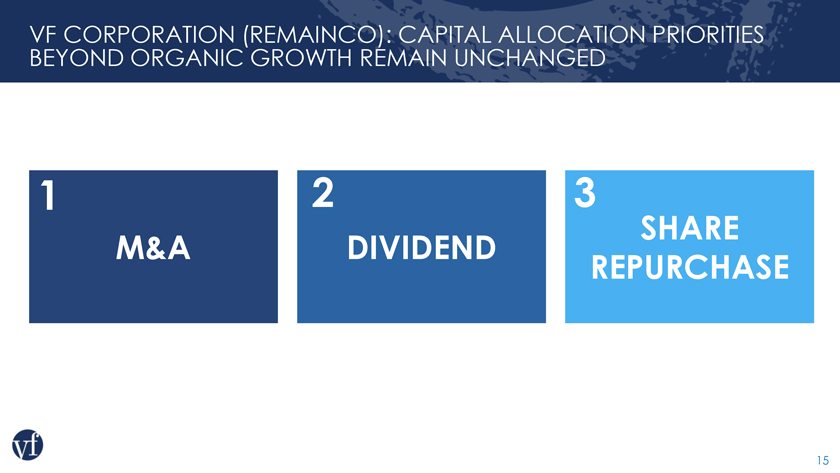

VF CORPORATION (REMAINCO): CAPITAL ALLOCATION PRIORITIES BEYOND ORGANIC GROWTH REMAIN UNCHANGED 1 2 3 SHARE M&A DIVIDEND REPURCHASE 15

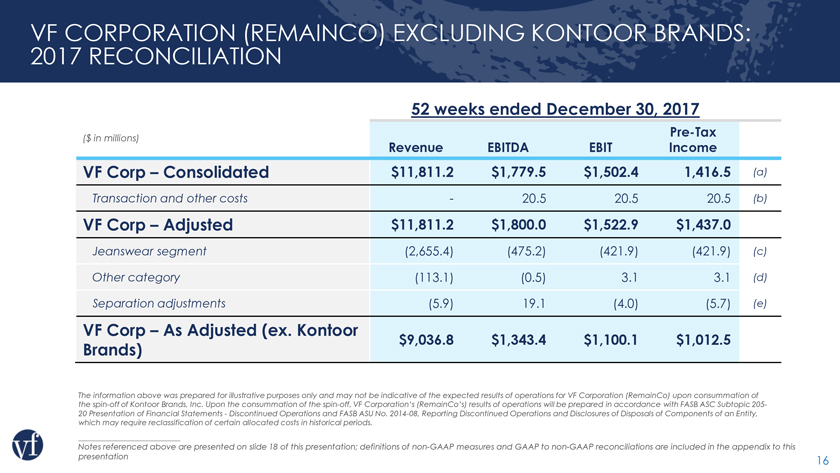

VF CORPORATION (REMAINCO) EXCLUDING KONTOOR BRANDS: 2017 RECONCILIATION 52 weeks ended December 30, 2017 ($ in millions) Pre-Tax Revenue EBITDA EBIT Income VF Corp – Consolidated $11,811.2 $1,779.5 $1,502.4 1,416.5 (a) Transaction and other costs - 20.5 20.5 20.5 (b) VF Corp – Adjusted $11,811.2 $1,800.0 $1,522.9 $1,437.0 Jeanswear segment (2,655.4) (475.2) (421.9) (421.9) (c) Other category (113.1) (0.5) 3.1 3.1 (d) Separation adjustments (5.9) 19.1 (4.0) (5.7) (e) VF Corp – As Adjusted (ex. Kontoor $9,036.8 $1,343.4 $1,100.1 $1,012.5 Brands) The information above was prepared for illustrative purposes only and may not be indicative of the expected results of operations for VF Corporation (RemainCo) upon consummation of the spin-off of Kontoor Brands, Inc. Upon the consummation of the spin-off, VF Corporation’s (RemainCo’s) results of operations will be prepared in accordance with FASB ASC Subtopic 205- 20 Presentation of Financial Statements—Discontinued Operations and FASB ASU No. 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, which may require reclassification of certain allocated costs in historical periods. GAAP definitions and GAAP to non-GAAP reconciliations are included in the appendix to this presentation Notes referenced above are presented on slide 18 of this presentation; definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation 16

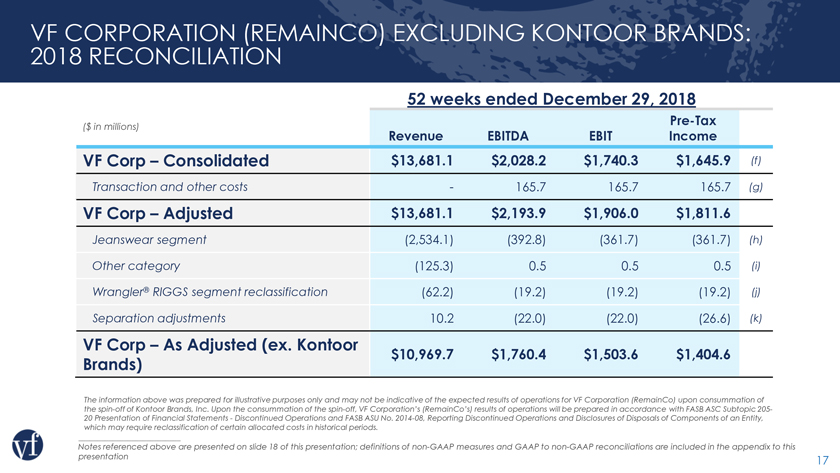

VF CORPORATION (REMAINCO) EXCLUDING KONTOOR BRANDS: 2018 RECONCILIATION 52 weeks ended December 29, 2018 ($ in millions) Pre-Tax Revenue EBITDA EBIT Income VF Corp – Consolidated $13,681.1 $2,028.2 $1,740.3 $1,645.9 (f) Transaction and other costs - 165.7 165.7 165.7 (g) VF Corp – Adjusted $13,681.1 $2,193.9 $1,906.0 $1,811.6 Jeanswear segment (2,534.1) (392.8) (361.7) (361.7) (h) Other category (125.3) 0.5 0.5 0.5 (i) Wrangler® RIGGS segment reclassification (62.2) (19.2) (19.2) (19.2) (j) Separation adjustments 10.2 (22.0) (22.0) (26.6) (k) VF Corp – As Adjusted (ex. Kontoor $10,969.7 $1,760.4 $1,503.6 $1,404.6 Brands) The information above was prepared for illustrative purposes only and may not be indicative of the expected results of operations for VF Corporation (RemainCo) upon consummation of the spin-off of Kontoor Brands, Inc. Upon the consummation of the spin-off, VF Corporation’s (RemainCo’s) results of operations will be prepared in accordance with FASB ASC Subtopic 205- 20 Presentation of Financial Statements—Discontinued Operations and FASB ASU No. 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, which may require reclassification of certain allocated costs in historical periods. Notes referenced above are presented on slide 18 of this presentation; definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation 17

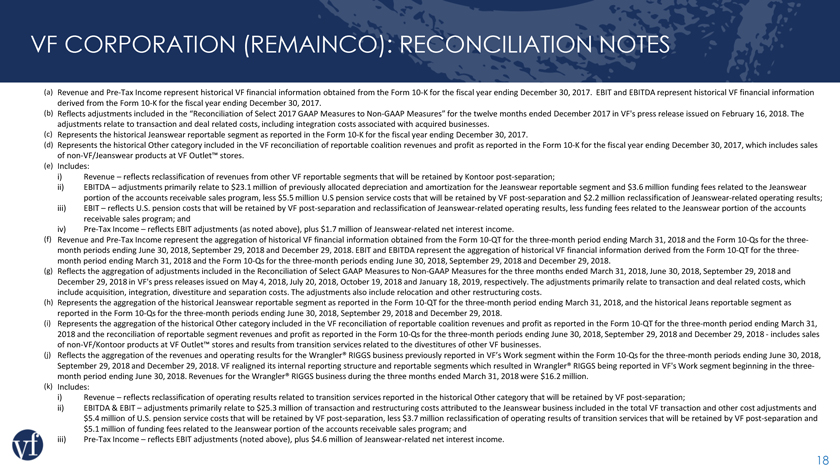

VF CORPORATION (REMAINCO): RECONCILIATION NOTES (a) Revenue and Pre-Tax Income represent historical VF financial information obtained from the Form 10-K for the fiscal year ending December 30, 2017. EBIT and EBITDA represent historical VF financial information derived from the Form 10-K for the fiscal year ending December 30, 2017. (b) Reflects adjustments included in the “Reconciliation of Select 2017 GAAP Measures to Non-GAAP Measures” for the twelve months ended December 2017 in VF’s press release issued on February 16, 2018. The adjustments relate to transaction and deal related costs, including integration costs associated with acquired businesses. (c) Represents the historical Jeanswear reportable segment as reported in the Form 10-K for the fiscal year ending December 30, 2017. (d) Represents the historical Other category included in the VF reconciliation of reportable coalition revenues and profit as reported in the Form 10-K for the fiscal year ending December 30, 2017, which includes sales of non-VF/Jeanswear products at VF Outlet™ stores. (e) Includes: i) Revenue – reflects reclassification of revenues from other VF reportable segments that will be retained by Kontoor post-separation; ii) EBITDA – adjustments primarily relate to $23.1 million of previously allocated depreciation and amortization for the Jeanswear reportable segment and $3.6 million funding fees related to the Jeanswear portion of the accounts receivable sales program, less $5.5 million U.S pension service costs that will be retained by VF post-separation and $2.2 million reclassification of Jeanswear-related operating results; iii) EBIT – reflects U.S. pension costs that will be retained by VF post-separation and reclassification of Jeanswear-related operating results, less funding fees related to the Jeanswear portion of the accounts receivable sales program; and iv) Pre-Tax Income – reflects EBIT adjustments (as noted above), plus $1.7 million of Jeanswear-related net interest income. (f) Revenue and Pre-Tax Income represent the aggregation of historical VF financial information obtained from the Form 10-QT for the three-month period ending March 31, 2018 and the Form 10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018. EBIT and EBITDA represent the aggregation of historical VF financial information derived from the Form 10-QT for the three-month period ending March 31, 2018 and the Form 10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018. (g) Reflects the aggregation of adjustments included in the Reconciliation of Select GAAP Measures to Non-GAAP Measures for the three months ended March 31, 2018, June 30, 2018, September 29, 2018 and December 29, 2018 in VF’s press releases issued on May 4, 2018, July 20, 2018, October 19, 2018 and January 18, 2019, respectively. The adjustments primarily relate to transaction and deal related costs, which include acquisition, integration, divestiture and separation costs. The adjustments also include relocation and other restructuring costs. (h) Represents the aggregation of the historical Jeanswear reportable segment as reported in the Form 10-QT for the three-month period ending March 31, 2018, and the historical Jeans reportable segment as reported in the Form 10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018. (i) Represents the aggregation of the historical Other category included in the VF reconciliation of reportable coalition revenues and profit as reported in the Form 10-QT for the three-month period ending March 31, 2018 and the reconciliation of reportable segment revenues and profit as reported in the Form 10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018—includes sales of non-VF/Kontoor products at VF Outlet™ stores and results from transition services related to the divestitures of other VF businesses. (j) Reflects the aggregation of the revenues and operating results for the Wrangler® RIGGS business previously reported in VF’s Work segment within the Form 10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018. VF realigned its internal reporting structure and reportable segments which resulted in Wrangler® RIGGS being reported in VF’s Work segment beginning in the three-month period ending June 30, 2018. Revenues for the Wrangler® RIGGS business during the three months ended March 31, 2018 were $16.2 million. (k) Includes: i) Revenue – reflects reclassification of operating results related to transition services reported in the historical Other category that will be retained by VF post-separation; ii) EBITDA & EBIT – adjustments primarily relate to $25.3 million of transaction and restructuring costs attributed to the Jeanswear business included in the total VF transaction and other cost adjustments and $5.4 million of U.S. pension service costs that will be retained by VF post-separation, less $3.7 million reclassification of operating results of transition services that will be retained by VF post-separation and $5.1 million of funding fees related to the Jeanswear portion of the accounts receivable sales program; and iii) Pre-Tax Income – reflects EBIT adjustments (noted above), plus $4.6 million of Jeanswear-related net interest income. 18

KONTOOR BRANDS 19

KONTOOR BRANDS: KEY INVESTMENT HIGHLIGHTS Global leader in denim with iconic Opportunity to pursue industry brands steeped in deep heritage and consolidation and strategic M&A over authenticity time (i.e. Horizon 2) Strong customer relationships, reliable Opportunity to unlock significant supply chain, channel and category scale and cost efficiencies management expertise Experienced management team with Attractive financial profile with strong deep knowledge of the global free cash flow generation, high dividend business focused on execution yield, and balance sheet flexibility 20

KONTOOR BRANDS AT A GLANCE Kontoor Brands is a global apparel leader focused on the design, manufacturing, sourcing, marketing, and distribution of a portfolio of brands, including the iconic Wrangler® and Lee® brands Two iconic and authentic brands in Wrangler® and Lee® with 200 combined years of heritage Vertically integrated supply chain producing or sourcing >170M units in 2018 Revenue: Longstanding global denim leadership $2.7B(1) Deep retail relationships across leading brick & mortar and e-commerce players Revenue and margin growth opportunities through continuing to “win with the winners” Global footprint across 65 countries with HQ in Greensboro, NC and ~17k employees worldwide Consistent business model that delivers strong and resilient margins and cash flows Strong dividend payout while (1) Numbers are on an As Adjusted basis for the 52 weeks ended December 29, 2018; continuing to invest in the future definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included 21 in the appendix to this presentation

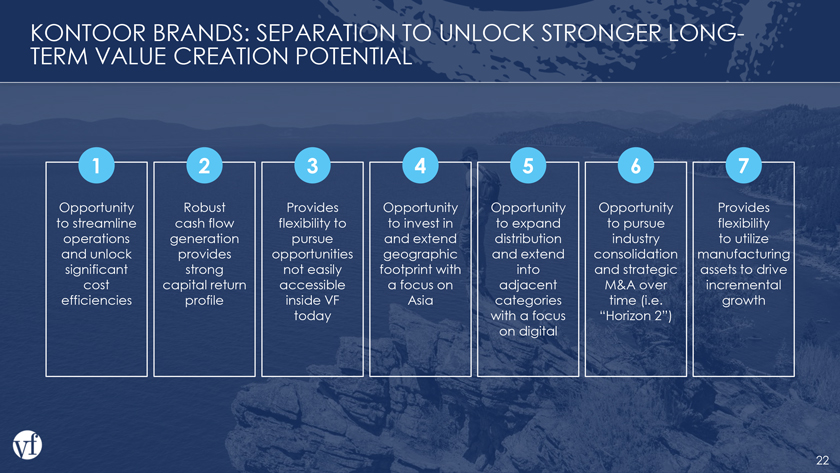

KONTOOR BRANDS: SEPARATION TO UNLOCK STRONGER LONG-TERM VALUE CREATION POTENTIAL 1 2 3 4 5 6 7 Opportunity Robust Provides Opportunity Opportunity Opportunity Provides to streamline cash flow flexibility to to invest in to expand to pursue flexibility operations generation pursue and extend distribution industry to utilize and unlock provides opportunities geographic and extend consolidation manufacturing significant strong not easily footprint with into and strategic assets to drive cost capital return accessible a focus on adjacent M&A over incremental efficiencies profile inside VF Asia categories time (i.e. growth today with a focus “Horizon 2”) on digital 22

RECONFIGURING KONTOOR BRANDS’ GLOBAL APPROACH VF Portfolio Management Standalone Kontoor Approach Independently operating Jeans Focused management team business units across three instilling an energized regional offices standalone culture Separate and brand-specific: Unified global brand and product approach Customer and marketing TO strategies Optimize supply chain Design & innovation platforms Leverage scale benefits Procurement strategies Realize cost efficiencies Identify and share best practices globally 23

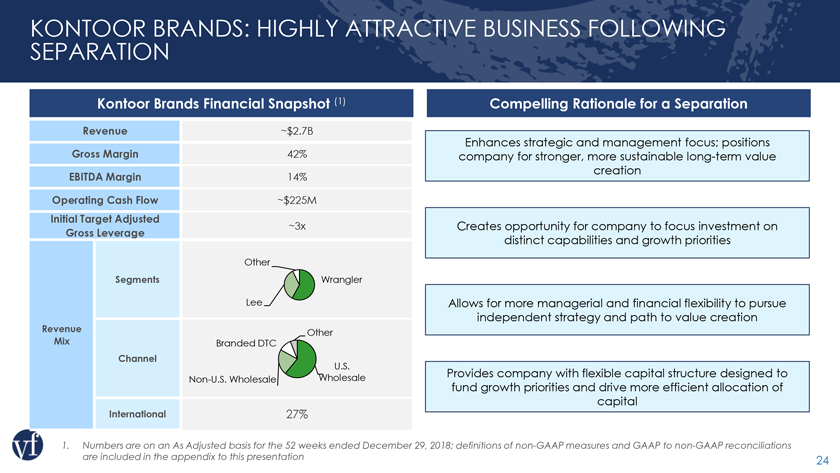

KONTOOR BRANDS: HIGHLY ATTRACTIVE BUSINESS FOLLOWING SEPARATION Kontoor Brands Financial Snapshot (1) Compelling Rationale for a Separation Revenue ~$2.7B Gross Margin 42% Enhances strategic and management focus; positions company for stronger, more sustainable long-term value creation EBITDA Margin 14% Operating Cash Flow ~$225M Initial Target Adjusted ~3x Creates opportunity for company to focus investment on Gross Leverage distinct capabilities and growth priorities Other Segments Wrangler Lee Allows for more managerial and financial flexibility to pursue Revenue independent strategy and path to value creation Other Mix Branded DTC Channel U.S. Wholesale Provides company with flexible capital structure designed to Non-U.S. Wholesale fund growth priorities and drive more efficient allocation of capital International 27% 1. Numbers are on an As Adjusted basis for the 52 weeks ended December 29, 2018; definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation 24

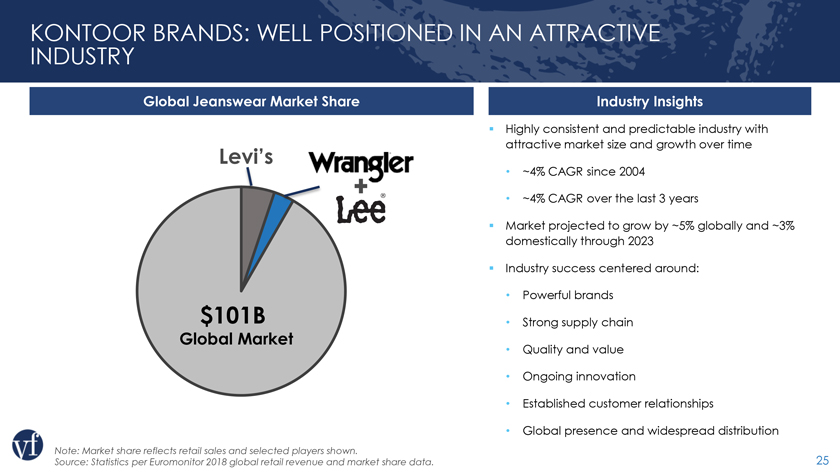

KONTOOR BRANDS: WELL POSITIONED IN AN ATTRACTIVE INDUSTRY Global Jeanswear Market Share Industry Insights Highly consistent and predictable industry with Levi’s attractive market size and growth over time • ~4% CAGR since 2004 • ~4% CAGR over the last 3 years Market projected to grow by ~5% globally and ~3% domestically through 2023 Industry success centered around: • Powerful brands $101B • Strong supply chain Global Market • Quality and value • Ongoing innovation • Established customer relationships • Global presence and widespread distribution Note: Market share reflects retail sales and selected players shown. Source: Statistics per Euromonitor 2018 global retail revenue and market share data. 25

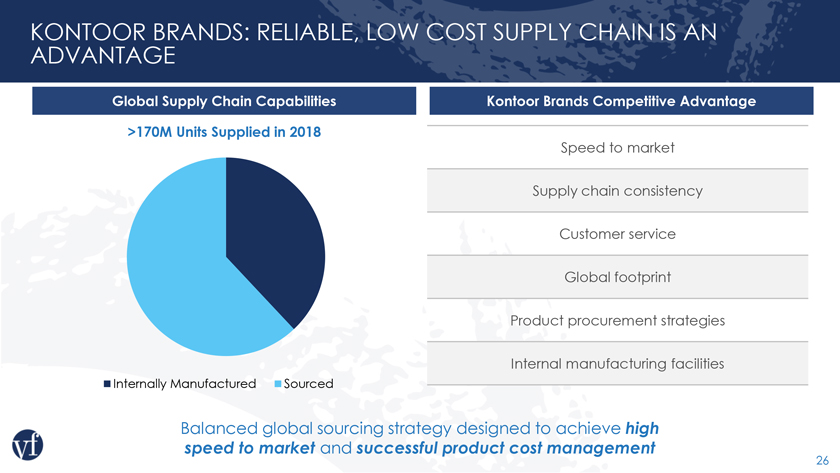

KONTOOR BRANDS: RELIABLE, LOW COST SUPPLY CHAIN IS AN ADVANTAGE Global Supply Chain Capabilities Kontoor Brands Competitive Advantage >170M Units Supplied in 2018 Speed to market Supply chain consistency Customer service Global footprint Product procurement strategies Internal manufacturing facilities Internally Manufactured Sourced Balanced global sourcing strategy designed to achieve high speed to market and successful product cost management 26

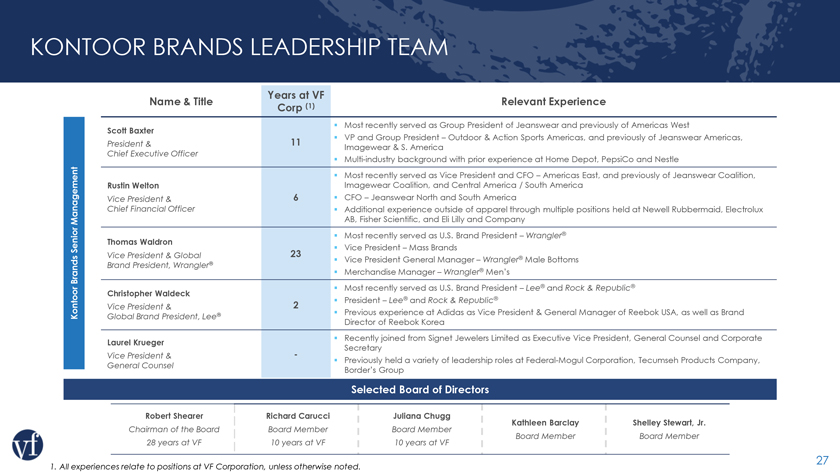

KONTOOR BRANDS LEADERSHIP TEAM Years at VF Name & Title (1) Relevant Experience Corp Most recently served as Group President of Jeanswear and previously of Americas West Scott Baxter 11 VP and Group President – Outdoor & Action Sports Americas, and previously of Jeanswear Americas, President & Imagewear & S. America Chief Executive Officer Multi-industry background with prior experience at Home Depot, PepsiCo and Nestle Most recently served as Vice President and CFO – Americas East, and previously of Jeanswear Coalition, Rustin Welton Imagewear Coalition, and Central America / South America Vice President & 6 CFO – Jeanswear North and South America Chief Financial Officer Additional experience outside of apparel through multiple positions held at Newell Rubbermaid, Electrolux Management AB, Fisher Scientific, and Eli Lilly and Company Thomas Waldron Most recently served as U.S. Brand President – Wrangler® Senior Vice President – Mass Brands Vice President & Global 23 Brand President, Wrangler® Vice President General Manager – Wrangler® Male Bottoms Brands Merchandise Manager – Wrangler® Men’s Most recently served as U.S. Brand President – Lee® and Rock & Republic® Christopher Waldeck President – Lee® and Rock & Republic® Vice President & 2 ® Previous experience at Adidas as Vice President & General Manager of Reebok USA, as well as Brand Kontoor Global Brand President, Lee Director of Reebok Korea Laurel Krueger Recently joined from Signet Jewelers Limited as Executive Vice President, General Counsel and Corporate Secretary Vice President & - Previously held a variety of leadership roles at Federal-Mogul Corporation, Tecumseh Products Company, General Counsel Border’s Group Selected Board of Directors Robert Shearer Richard Carucci Juliana Chugg Kathleen Barclay Shelley Stewart, Jr. Chairman of the Board Board Member Board Member Board Member Board Member 28 years at VF 10 years at VF 10 years at VF 27 1. All experiences relate to positions at VF Corporation, unless otherwise noted.

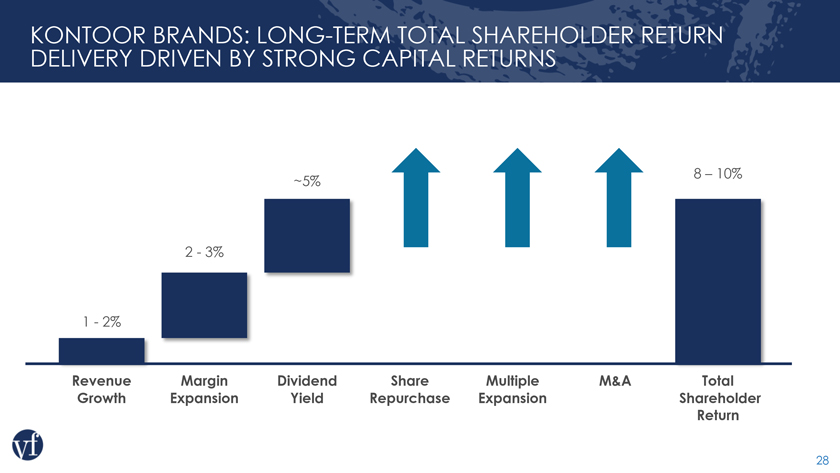

KONTOOR BRANDS: LONG-TERM TOTAL SHAREHOLDER RETURN DELIVERY DRIVEN BY STRONG CAPITAL RETURNS 8 – 10% ~5% 2—3% 1—2% Revenue Margin Dividend Share Multiple M&A Total Growth Expansion Yield Repurchase Expansion Shareholder Return 28

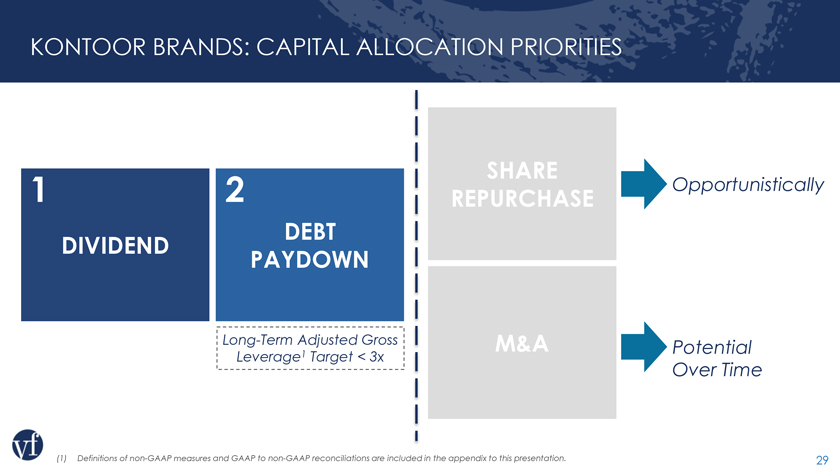

KONTOOR BRANDS: CAPITAL ALLOCATION PRIORITIES SHARE 1 2 REPURCHASE Opportunistically DEBT DIVIDEND PAYDOWN Long-Term Adjusted Gross M&A Potential Leverage1 Target < 3x Over Time (1) Definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation. 29

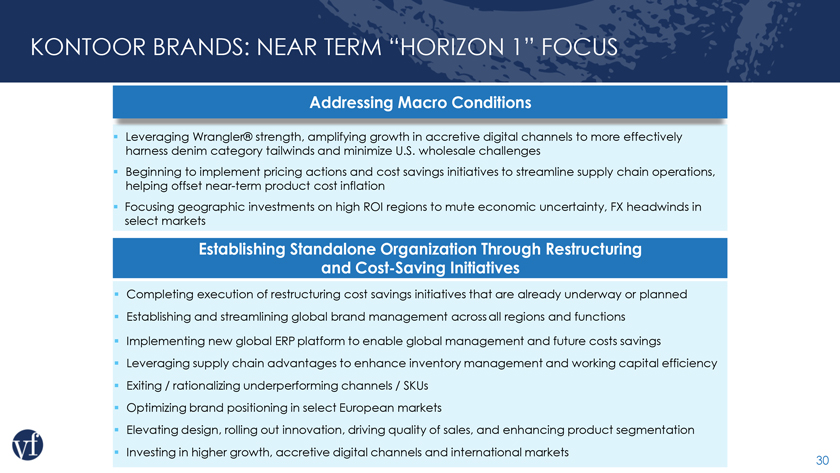

KONTOOR BRANDS: NEAR TERM “HORIZON 1” FOCUS Addressing Macro Conditions Leveraging Wrangler® strength, amplifying growth in accretive digital channels to more effectively harness denim category tailwinds and minimize U.S. wholesale challenges Beginning to implement pricing actions and cost savings initiatives to streamline supply chain operations, helping offset near-term product cost inflation Focusing geographic investments on high ROI regions to mute economic uncertainty, FX headwinds in select markets Establishing Standalone Organization Through Restructuring and Cost-Saving Initiatives Completing execution of restructuring cost savings initiatives that are already underway or planned Establishing and streamlining global brand management acrossall regions and functions Implementing new global ERP platform to enable global management and future costs savings Leveraging supply chain advantages to enhance inventory management and working capital efficiency Exiting / rationalizing underperforming channels / SKUs Optimizing brand positioning in select European markets Elevating design, rolling out innovation, driving quality of sales, and enhancing product segmentation Investing in higher growth, accretive digital channels and international markets 30

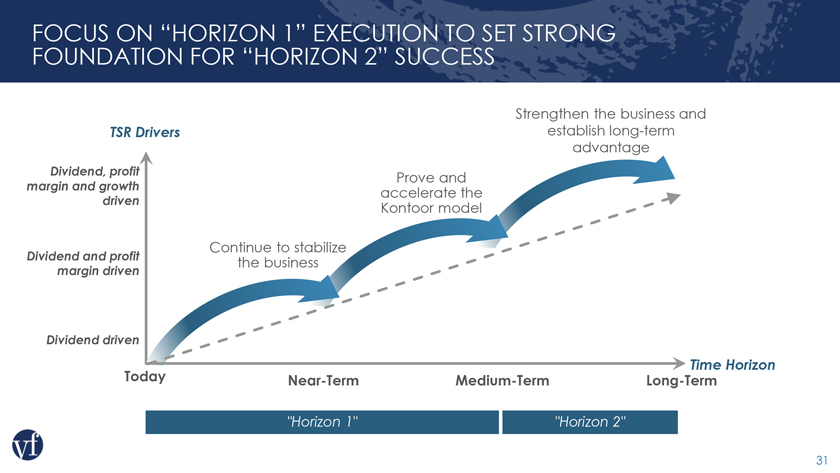

FOCUS ON “HORIZON 1” EXECUTION TO SET STRONG FOUNDATION FOR “HORIZON 2” SUCCESS Strengthen the business and TSR Drivers establish long-term advantage Dividend, profit Prove and margin and growth accelerate the driven Kontoor model Continue to stabilize Dividend and profit the business margin driven Dividend driven Time Horizon Today Near-Term Medium-Term Long-Term “Horizon 1” “Horizon 2” 31

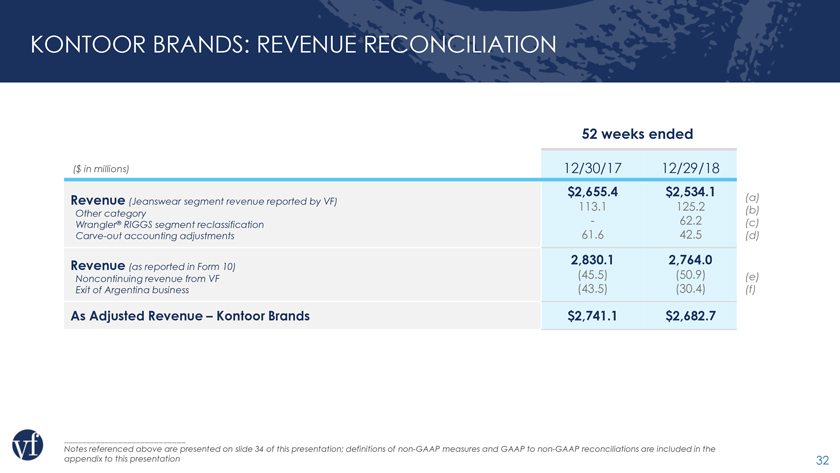

KONTOOR BRANDS: REVENUE RECONCILIATION 52 weeks ended ($ in millions) 12/30/17 12/29/18 $2,655.4 $2,534.1 (a) Revenue (Jeanswear segment revenue reported by VF) 113.1 125.2 Other category (b) Wrangler® RIGGS segment reclassification - 62.2 (c) Carve-out accounting adjustments 61.6 42.5 (d) 2,830.1 2,764.0 Revenue (as reported in Form 10) Noncontinuing revenue from VF (45.5) (50.9) (e) Exit of Argentina business (43.5) (30.4) (f) As Adjusted Revenue – Kontoor Brands $2,741.1 $2,682.7 Notes referenced above are presented on slide 34 of this presentation; definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation 32

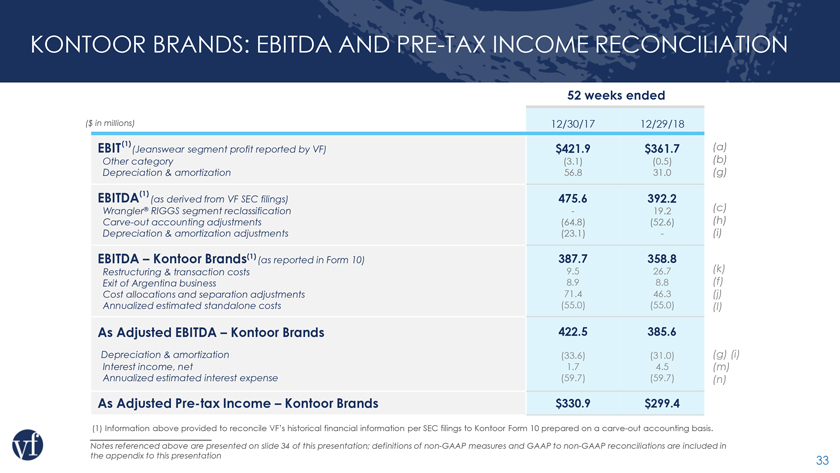

KONTOOR BRANDS: EBITDA AND PRE-TAX INCOME RECONCILIATION 52 weeks ended ($ in millions) 12/30/17 12/29/18 EBIT(1) (Jeanswear segment profit reported by VF) $421.9 $361.7 (a) Other category (3.1) (0.5) (b) Depreciation & amortization 56.8 31.0 (g) EBITDA(1) (as derived from VF SEC filings) 475.6 392.2 Wrangler® RIGGS segment reclassification - 19.2 (c) Carve-out accounting adjustments (64.8) (52.6) (h) Depreciation & amortization adjustments (23.1)—(i) EBITDA – Kontoor Brands(1) (as reported in Form 10) 387.7 358.8 Restructuring & transaction costs 9.5 26.7 (k) Exit of Argentina business 8.9 8.8 (f) Cost allocations and separation adjustments 71.4 46.3 (j) Annualized estimated standalone costs (55.0) (55.0) (l) As Adjusted EBITDA – Kontoor Brands 422.5 385.6 Depreciation & amortization (33.6) (31.0) (g) (i) Interest income, net 1.7 4.5 (m) Annualized estimated interest expense (59.7) (59.7) (n) As Adjusted Pre-tax Income – Kontoor Brands $330.9 $299.4 (1) Information above provided to reconcile VF’s historical financial information per SEC filings to Kontoor Form 10 prepared on a carve-out accounting basis. Notes referenced above are presented on slide 34 of this presentation; definitions of non-GAAP measures and GAAP to non-GAAP reconciliations are included in the appendix to this presentation 33

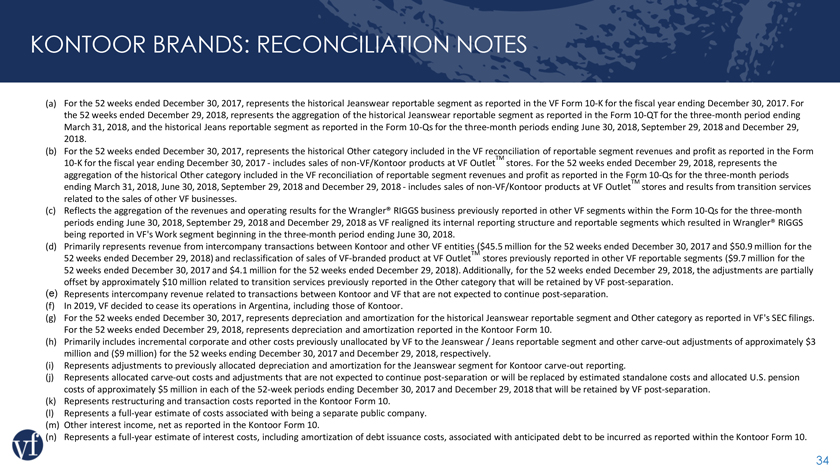

KONTOOR BRANDS: RECONCILIATION NOTES (a) For the 52 weeks ended December 30, 2017, represents the historical Jeanswear reportable segment as reported in the VF Form 10-K for the fiscal year ending December 30, 2017. For the 52 weeks ended December 29, 2018, represents the aggregation of the historical Jeanswear reportable segment as reported in the Form 10-QT for the three-month period ending March 31, 2018, and the historical Jeans reportable segment as reported in the Form 10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018. (b) For the 52 weeks ended December 30, 2017, represents the historical Other category included in the VF reconciliation of reportable segment revenues and profit as reported in the Form 10-K for the fiscal year ending December 30, 2017—includes sales of non-VF/Kontoor products at VF OutletTM stores. For the 52 weeks ended December 29, 2018, represents the aggregation of the historical Other category included in the VF reconciliation of reportable segment revenues and profit as reported in the Form 10-Qs for the three-month periods ending March 31, 2018, June 30, 2018, September 29, 2018 and December 29, 2018—includes sales of non-VF/Kontoor products at VF OutletTM stores and results from transition services related to the sales of other VF businesses. (c) Reflects the aggregation of the revenues and operating results for the Wrangler® RIGGS business previously reported in other VF segments within the Form 10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018 as VF realigned its internal reporting structure and reportable segments which resulted in Wrangler® RIGGS being reported in VF’s Work segment beginning in the three-month period ending June 30, 2018. (d) Primarily represents revenue from intercompany transactions between Kontoor and other VF entities ($45.5 million for the 52 weeks ended December 30, 2017 and $50.9 million for the 52 weeks ended December 29, 2018) and reclassification of sales of VF-branded product at VF OutletTM stores previously reported in other VF reportable segments ($9.7 million for the 52 weeks ended December 30, 2017 and $4.1 million for the 52 weeks ended December 29, 2018). Additionally, for the 52 weeks ended December 29, 2018, the adjustments are partially offset by approximately $10 million related to transition services previously reported in the Other category that will be retained by VF post-separation. (e) Represents intercompany revenue related to transactions between Kontoor and VF that are not expected to continue post-separation. (f) In 2019, VF decided to cease its operations in Argentina, including those of Kontoor. (g) For the 52 weeks ended December 30, 2017, represents depreciation and amortization for the historical Jeanswear reportable segment and Other category as reported in VF’s SEC filings. For the 52 weeks ended December 29, 2018, represents depreciation and amortization reported in the Kontoor Form 10. (h) Primarily includes incremental corporate and other costs previously unallocated by VF to the Jeanswear / Jeans reportable segment and other carve-out adjustments of approximately $3 million and ($9 million) for the 52 weeks ending December 30, 2017 and December 29, 2018, respectively. (i) Represents adjustments to previously allocated depreciation and amortization for the Jeanswear segment for Kontoor carve-out reporting. (j) Represents allocated carve-out costs and adjustments that are not expected to continue post-separation or will be replaced by estimated standalone costs and allocated U.S. pension costs of approximately $5 million in each of the 52-week periods ending December 30, 2017 and December 29, 2018 that will be retained by VF post-separation. (k) Represents restructuring and transaction costs reported in the Kontoor Form 10. (l) Represents a full-year estimate of costs associated with being a separate public company. (m) Other interest income, net as reported in the Kontoor Form 10. (n) Represents a full-year estimate of interest costs, including amortization of debt issuance costs, associated with anticipated debt to be incurred as reported within the Kontoor Form 10. 34

APPENDIX 35

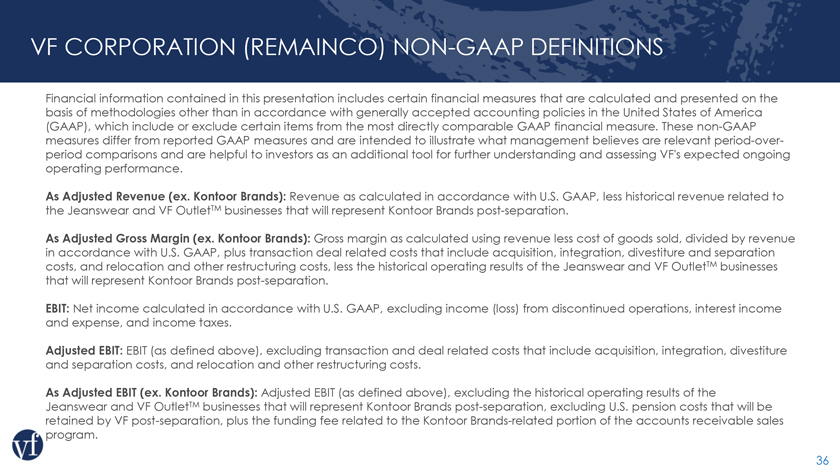

VF CORPORATION (REMAINCO) NON-GAAP DEFINITIONS Financial information contained in this presentation includes certain financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting policies in the United States of America (GAAP), which include or exclude certain items from the most directly comparable GAAP financial measure. These non-GAAP measures differ from reported GAAP measures and are intended to illustrate what management believes are relevant period-over-period comparisons and are helpful to investors as an additional tool for further understanding and assessing VF’s expected ongoing operating performance. As Adjusted Revenue (ex. Kontoor Brands): Revenue as calculated in accordance with U.S. GAAP, less historical revenue related to the Jeanswear and VF OutletTM businesses that will represent Kontoor Brands post-separation. As Adjusted Gross Margin (ex. Kontoor Brands): Gross margin as calculated using revenue less cost of goods sold, divided by revenue in accordance with U.S. GAAP, plus transaction deal related costs that include acquisition, integration, divestiture and separation costs, and relocation and other restructuring costs, less the historical operating results of the Jeanswear and VF OutletTM businesses that will represent Kontoor Brands post-separation. EBIT: Net income calculated in accordance with U.S. GAAP, excluding income (loss) from discontinued operations, interest income and expense, and income taxes. Adjusted EBIT: EBIT (as defined above), excluding transaction and deal related costs that include acquisition, integration, divestiture and separation costs, and relocation and other restructuring costs. As Adjusted EBIT (ex. Kontoor Brands): Adjusted EBIT (as defined above), excluding the historical operating results of the Jeanswear and VF OutletTM businesses that will represent Kontoor Brands post-separation, excluding U.S. pension costs that will be retained by VF post-separation, plus the funding fee related to the Kontoor Brands-related portion of the accounts receivable sales program. 36

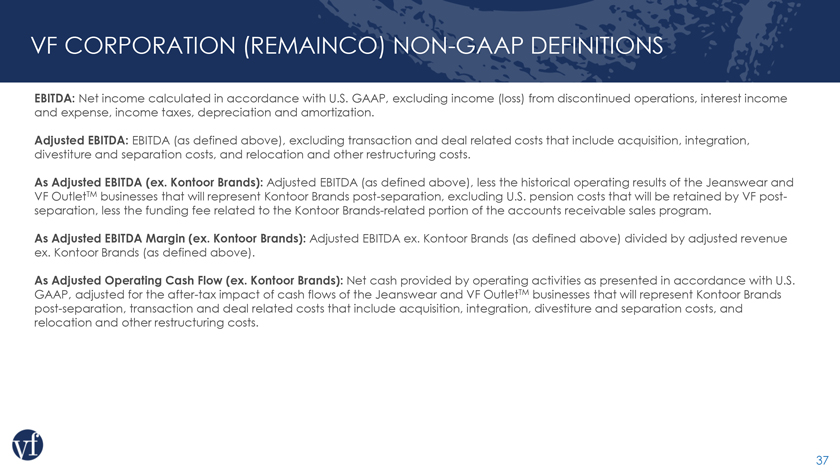

VF CORPORATION (REMAINCO) NON-GAAP DEFINITIONS EBITDA: Net income calculated in accordance with U.S. GAAP, excluding income (loss) from discontinued operations, interest income and expense, income taxes, depreciation and amortization. Adjusted EBITDA: EBITDA (as defined above), excluding transaction and deal related costs that include acquisition, integration, divestiture and separation costs, and relocation and other restructuring costs. As Adjusted EBITDA (ex. Kontoor Brands): Adjusted EBITDA (as defined above), less the historical operating results of the Jeanswear and VF OutletTM businesses that will represent Kontoor Brands post-separation, excluding U.S. pension costs that will be retained by VF post-separation, less the funding fee related to the Kontoor Brands-related portion of the accounts receivable sales program. As Adjusted EBITDA Margin (ex. Kontoor Brands): Adjusted EBITDA ex. Kontoor Brands (as defined above) divided by adjusted revenue ex. Kontoor Brands (as defined above). As Adjusted Operating Cash Flow (ex. Kontoor Brands): Net cash provided by operating activities as presented in accordance with U.S. GAAP, adjusted for the after-tax impact of cash flows of the Jeanswear and VF OutletTM businesses that will represent Kontoor Brands post-separation, transaction and deal related costs that include acquisition, integration, divestiture and separation costs, and relocation and other restructuring costs. 37

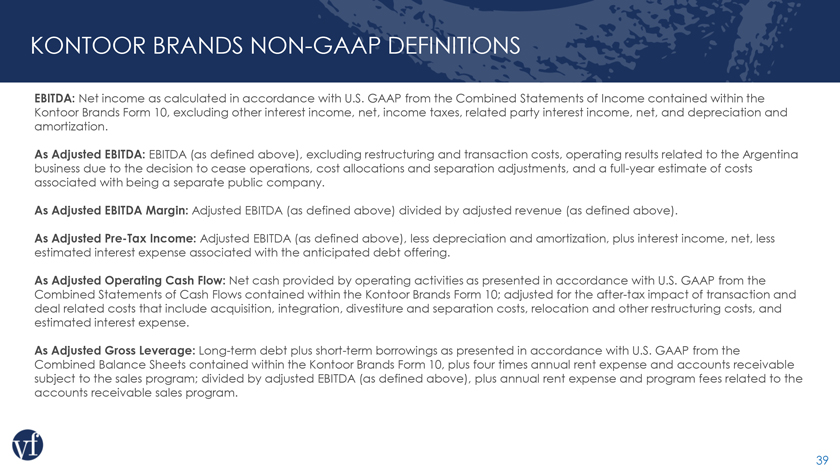

KONTOOR BRANDS NON-GAAP DEFINITIONS Financial information contained in this presentation includes certain financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting policies in the United States of America (GAAP), which include or exclude certain items from the most directly comparable GAAP financial measure. These non-GAAP measures differ from reported GAAP measures and are intended to illustrate what management believes are relevant period-over-period comparisons and are helpful to investors as an additional tool for further understanding and assessing Kontoor Brands’ expected ongoing operating performance. As Adjusted Revenue: Revenue as calculated in accordance with U.S. GAAP from the Combined Statements of Income contained within the Kontoor Brands Form 10, less intercompany revenue related to transactions with VF that are not expected to continue post-separation and revenue related to the Argentina business due to the decision to cease operations. As Adjusted Gross Margin: Gross margin as calculated using revenue less cost of goods sold, divided by revenue in accordance with U.S. GAAP from the Combined Statements of Income contained within the Kontoor Brands Form 10, less operating results of activities with VF that are not expected to continue post-separation and results related to the Argentina business due to the decision to cease operations, plus restructuring costs. EBIT: Net income as calculated in accordance with U.S. GAAP from the Combined Statements of Income contained within the Kontoor Brands Form 10, excluding other interest income, net, income taxes and related party interest income, net. 38

KONTOOR BRANDS NON-GAAP DEFINITIONS EBITDA: Net income as calculated in accordance with U.S. GAAP from the Combined Statements of Income contained within the Kontoor Brands Form 10, excluding other interest income, net, income taxes, related party interest income, net, and depreciation and amortization. As Adjusted EBITDA: EBITDA (as defined above), excluding restructuring and transaction costs, operating results related to the Argentina business due to the decision to cease operations, cost allocations and separation adjustments, and a full-year estimate of costs associated with being a separate public company. As Adjusted EBITDA Margin: Adjusted EBITDA (as defined above) divided by adjusted revenue (as defined above). As Adjusted Pre-Tax Income: Adjusted EBITDA (as defined above), less depreciation and amortization, plus interest income, net, less estimated interest expense associated with the anticipated debt offering. As Adjusted Operating Cash Flow: Net cash provided by operating activities as presented in accordance with U.S. GAAP from the Combined Statements of Cash Flows contained within the Kontoor Brands Form 10; adjusted for the after-tax impact of transaction and deal related costs that include acquisition, integration, divestiture and separation costs, relocation and other restructuring costs, and estimated interest expense. As Adjusted Gross Leverage: Long-term debt plus short-term borrowings as presented in accordance with U.S. GAAP from the Combined Balance Sheets contained within the Kontoor Brands Form 10, plus four times annual rent expense and accounts receivable subject to the sales program; divided by adjusted EBITDA (as defined above), plus annual rent expense and program fees related to the accounts receivable sales program. 39

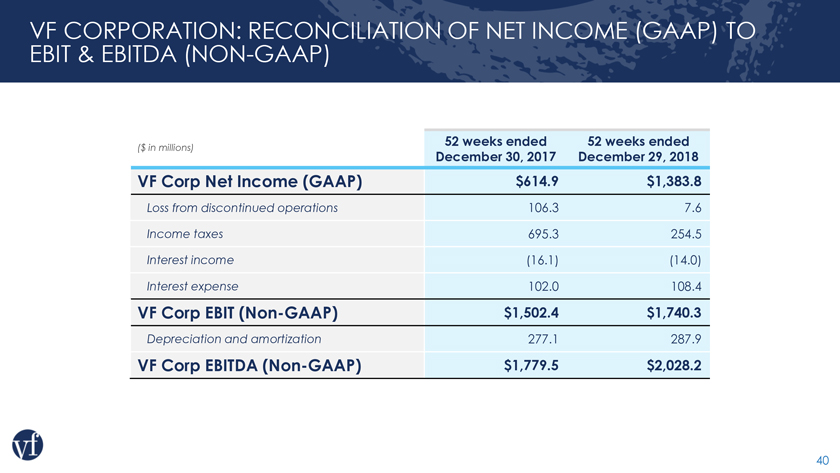

VF CORPORATION: RECONCILIATION OF NET INCOME (GAAP) TO EBIT & EBITDA (NON-GAAP) ($ in millions) 52 weeks ended 52 weeks ended December 30, 2017 December 29, 2018 VF Corp Net Income (GAAP) $614.9 $1,383.8 Loss from discontinued operations 106.3 7.6 Income taxes 695.3 254.5 Interest income (16.1) (14.0) Interest expense 102.0 108.4 VF Corp EBIT (Non-GAAP) $1,502.4 $1,740.3 Depreciation and amortization 277.1 287.9 VF Corp EBITDA (Non-GAAP) $1,779.5 $2,028.2 40

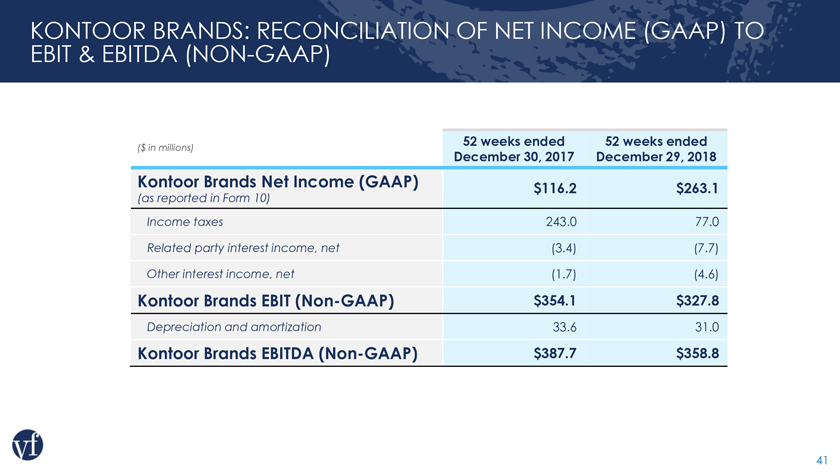

KONTOOR BRANDS: RECONCILIATION OF NET INCOME (GAAP) TO EBIT & EBITDA (NON-GAAP) ($ in millions) 52 weeks ended 52 weeks ended December 30, 2017 December 29, 2018 Kontoor Brands Net Income (GAAP) $116.2 $263.1 (as reported in Form 10) Income taxes 243.0 77.0 Related party interest income, net (3.4) (7.7) Other interest income, net (1.7) (4.6) Kontoor Brands EBIT (Non-GAAP) $354.1 $327.8 Depreciation and amortization 33.6 31.0 Kontoor Brands EBITDA (Non-GAAP) $387.7 $358.8 41

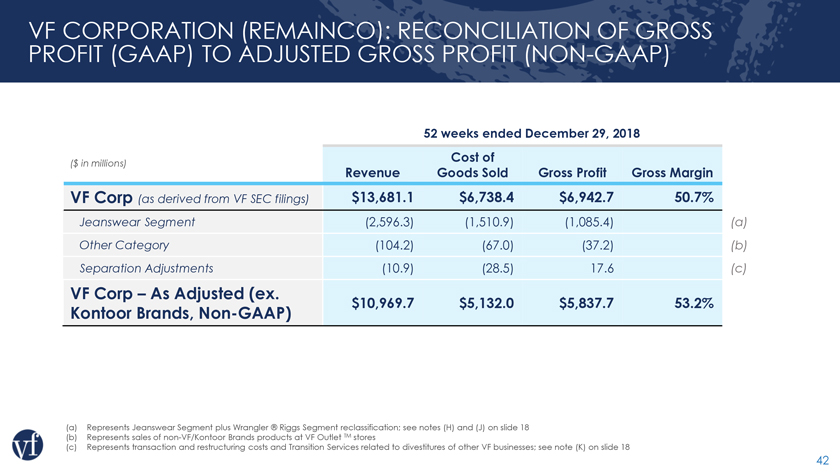

VF CORPORATION (REMAINCO): RECONCILIATION OF GROSS PROFIT (GAAP) TO ADJUSTED GROSS PROFIT (NON-GAAP) 52 weeks ended December 29, 2018 ($ in millions) Cost of Revenue Goods Sold Gross Profit Gross Margin VF Corp (as derived from VF SEC filings) $13,681.1 $6,738.4 $6,942.7 50.7% Jeanswear Segment (2,596.3) (1,510.9) (1,085.4) (a) Other Category (104.2) (67.0) (37.2) (b) Separation Adjustments (10.9) (28.5) 17.6 (c) VF Corp – As Adjusted (ex. $10,969.7 $5,132.0 $5,837.7 53.2% Kontoor Brands, Non-GAAP) (a) Represents Jeanswear Segment plus Wrangler ® Riggs Segment reclassification; see notes (H) and (J) on slide 18 (b) Represents sales of non-VF/Kontoor Brands products at VF Outlet TM stores (c) Represents transaction and restructuring costs and Transition Services related to divestitures of other VF businesses; see note (K) on slide 18 42

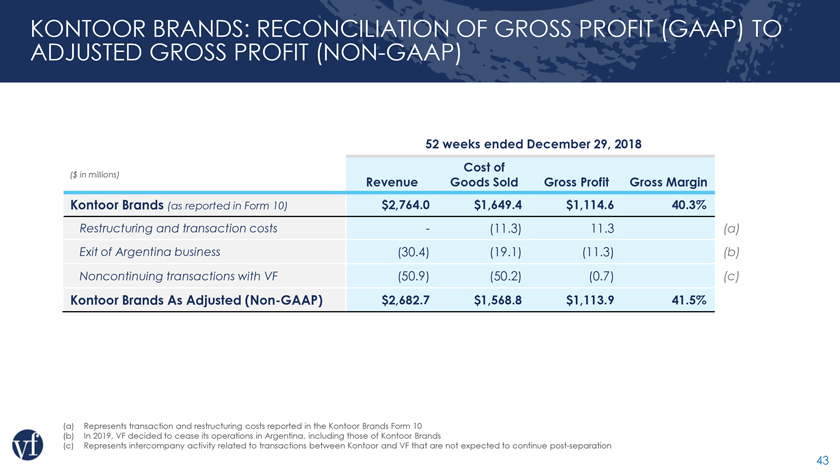

KONTOOR BRANDS: RECONCILIATION OF GROSS PROFIT (GAAP) TO ADJUSTED GROSS PROFIT (NON-GAAP) 52 weeks ended December 29, 2018 Cost of ($ in millions) Revenue Goods Sold Gross Profit Gross Margin Kontoor Brands (as reported in Form 10) $2,764.0 $1,649.4 $1,114.6 40.3% Restructuring and transaction costs - (11.3) 11.3 (a) Exit of Argentina business (30.4) (19.1) (11.3) (b) Noncontinuing transactions with VF (50.9) (50.2) (0.7) (c) Kontoor Brands As Adjusted (Non-GAAP) $2,682.7 $1,568.8 $1,113.9 41.5% (a) Represents transaction and restructuring costs reported in the Kontoor Brands Form 10 (b) In 2019, VF decided to cease its operations in Argentina, including those of Kontoor Brands (c) Represents intercompany activity related to transactions between Kontoor and VF that are not expected to continue post-separation 43

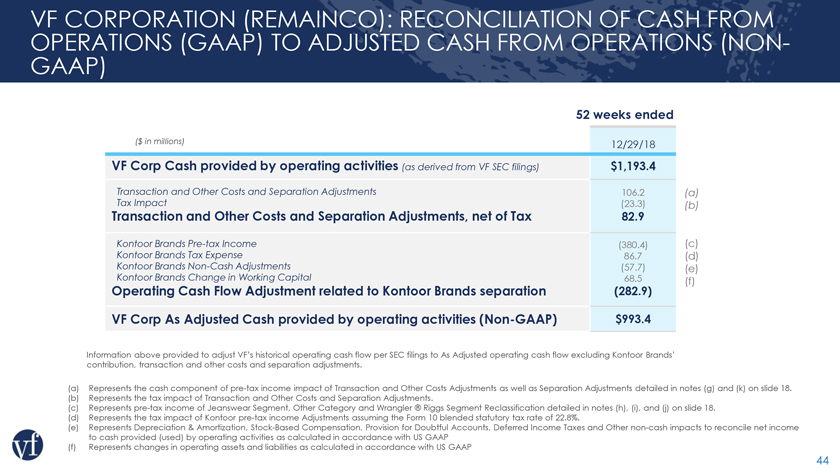

VF CORPORATION (REMAINCO): RECONCILIATION OF CASH FROM OPERATIONS (GAAP) TO ADJUSTED CASH FROM OPERATIONS (NON-GAAP) 52 weeks ended ($ in millions) 12/29/18 VF Corp Cash provided by operating activities (as derived from VF SEC filings) $1,193.4 Transaction and Other Costs and Separation Adjustments 106.2 (a) Tax Impact (23.3) (b) Transaction and Other Costs and Separation Adjustments, net of Tax 82.9 Kontoor Brands Pre-tax Income (380.4) (c) Kontoor Brands Tax Expense 86.7 (d) Kontoor Brands Non-Cash Adjustments (57.7) (e) Kontoor Brands Change in Working Capital 68.5 (f) Operating Cash Flow Adjustment related to Kontoor Brands separation (282.9) VF Corp As Adjusted Cash provided by operating activities (Non-GAAP) $993.4 Information above provided to adjust VF’s historical operating cash flow per SEC filings to As Adjusted operating cash flow excluding Kontoor Brands’ contribution, transaction and other costs and separation adjustments. (a) Represents the cash component of pre-tax income impact of Transaction and Other Costs Adjustments as well as Separation Adjustments detailed in notes (g) and (k) on slide 18. (b) Represents the tax impact of Transaction and Other Costs and Separation Adjustments. (c) Represents pre-tax income of Jeanswear Segment, Other Category and Wrangler ® Riggs Segment Reclassification detailed in notes (h), (i), and (j) on slide 18. (d) Represents the tax impact of Kontoor pre-tax income Adjustments assuming the Form 10 blended statutory tax rate of 22.8%. (e) Represents Depreciation & Amortization, Stock-Based Compensation, Provision for Doubtful Accounts, Deferred Income Taxes and Other non-cash impacts to reconcile net income to cash provided (used) by operating activities as calculated in accordance with US GAAP (f) Represents changes in operating assets and liabilities as calculated in accordance with US GAAP 44

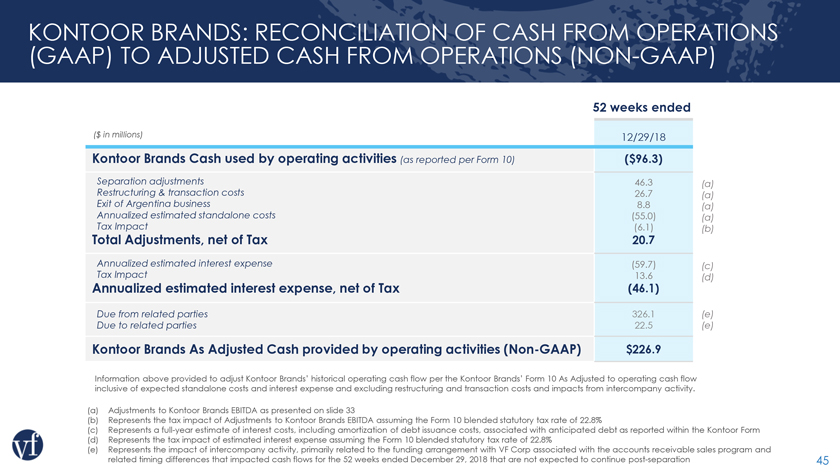

KONTOOR BRANDS: RECONCILIATION OF CASH FROM OPERATIONS (GAAP) TO ADJUSTED CASH FROM OPERATIONS

(NON-GAAP) 52 weeks ended ($ in millions) 12/29/18 Kontoor Brands Cash used by operating activities (as reported per Form 10) ($96.3) Separation adjustments 46.3 (a) Restructuring & transaction costs

26.7 (a) Exit of Argentina business 8.8 (a) Annualized illustrative standalone costs (55.0) (a) Tax Impact (6.1) (b) Total Adjustments, net of Tax 20.7 Annualized estimated interest expense (59.7) (c) Tax Impact 13.6 (d) Annualized estimated

interest expense, net of Tax (46.1) Due from related parties 326.1 (e) Due to related parties 22.5 (e) Kontoor Brands As Adjusted Cash provided by operating activities (Non-GAAP) $226.9 Information above

provided to adjust Kontoor Brands’ historical operating cash flow per the Kontoor Brands’ Form 10 As Adjusted to operating cash flow inclusive of expected standalone costs and interest expense and excluding restructuring and transaction

costs and impacts from intercompany activity. (a) Adjustments to Kontoor Brands EBITDA as presented on slide 33 (b) Represents the tax impact of Adjustments to Kontoor Brands EBITDA assuming the Form 10 blended statutory tax rate of 22.8% (c)

Represents a full-year estimate of interest costs, including amortization of debt issuance costs, associated with anticipated debt as reported within the Kontoor Form 10. (d) Represents the tax impact of Illustrative interest expense assuming the

Form 10 blended statutory tax rate of 22.8% (e) Represents the impact of intercompany activity, primarily related to the funding arrangement with VF Corp associated with the accounts receivable sales program and related timing differences that

impacted cash flows for the 52 weeks ended December 29, 2018 that are not expected to continue post-separation 45

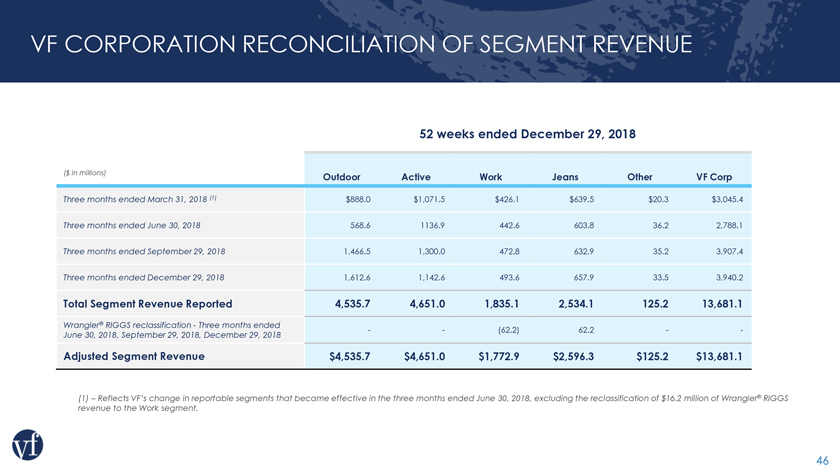

VF CORPORATION RECONCILIATION OF SEGMENT REVENUE 52 weeks ended December 29, 2018 ($ in millions) Outdoor Active Work Jeans Other VF Corp Three months ended March 31, 2018 (1) $888.0 $1,071.5 $426.1 $639.5 $20.3 $3,045.4 Three months ended June 30, 2018 568.6 1136.9 442.6 603.8 36.2 2,788.1 Three months ended September 29, 2018 1,466.5 1,300.0 472.8 632.9 35.2 3,907.4 Three months ended December 29, 2018 1,612.6 1,142.6 493.6 657.9 33.5 3,940.2 Total Segment Revenue Reported 4,535.7 4,651.0 1,835.1 2,534.1 125.2 13,681.1 Wrangler® RIGGS reclassification—Three months ended — (62.2) 62.2 — June 30, 2018, September 29, 2018, December 29, 2018 Adjusted Segment Revenue $4,535.7 $4,651.0 $1,772.9 $2,596.3 $125.2 $13,681.1 (1) – Reflects VF’s change in reportable segments that became effective in the three months ended June 30, 2018, excluding the reclassification of $16.2 million of Wrangler® RIGGS revenue to the Work segment. definitions and GAAP to non-GAAP reconciliations are included in the appendix to this presentation 46