VF CORPORATION

June 11, 2021

Dear Fellow Shareholders:

We are pleased to invite you to the 2021 Annual Meeting of Shareholders of VF Corporation, to be held Tuesday, July 27, 2021, live via the Internet at www.proxydocs.com/VFC, commencing at 10:30 a.m., Mountain Daylight Time. In light of the ongoing COVID-19 pandemic and uncertainty related to the pandemic, and after careful consideration, our Board of Directors has determined to hold a virtual annual meeting in order to facilitate shareholder attendance and participation by enabling shareholders to participate from any location and at no cost. We believe this is the right choice for VF at this time, as it enables engagement with our shareholders, regardless of size, resources, or physical location while safeguarding the health of our shareholders, Board and management. Shareholders will not be able to attend the meeting in person.

We are committed to ensuring that shareholders who attend the virtual meeting are afforded the same rights and opportunities to participate as they would at an in-person meeting, using online tools to ensure shareholder access and participation. To attend the meeting, shareholders must register, using their control number and other information, at www.proxydocs.com/VFC. Upon completing registration, shareholders will receive further instructions by email, including links that will allow them to access the meeting, vote online during the meeting and, if they register prior to 5:00 p.m., Eastern Daylight Time, on Friday, July 23, 2021, submit questions for the meeting.

At the meeting, shareholders will be asked to vote on (i) the election of directors; (ii) approval of the compensation of named executive officers as disclosed in this proxy statement; (iii) ratification of the selection of PricewaterhouseCoopers LLP as VF’s independent registered public accounting firm for fiscal 2022; and (iv) such other matters as may properly come before the meeting.

Your Board of Directors recommends a vote “FOR” the election of the persons nominated to serve as directors, “FOR” the approval of compensation of named executive officers as disclosed in this proxy statement, and “FOR” the ratification of the selection of PricewaterhouseCoopers LLP as VF’s independent registered public accounting firm. Regardless of the number of shares you own or whether you plan to attend the virtual meeting, it is important that your shares be represented and voted at the meeting.

On or about June 11, 2021, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all shareholders of record on our books at the close of business on May 28, 2021, the record date for the meeting, and will post our proxy materials on the website referenced in the Notice. As more fully described in the Notice, shareholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail, or electronically by email, on an ongoing basis.

You may vote by attending the virtual meeting or you may vote your shares via the Internet, via a toll-free telephone number, or by signing, dating and mailing a completed proxy card, as explained on pages 2 and 3 of the attached proxy statement.

Your interest and participation in the affairs of VF are most appreciated.

Sincerely,

Steven E. Rendle

Chairman, President and Chief Executive Officer

BY INTERNET:

BY INTERNET: BY TELEPHONE:

BY TELEPHONE: BY MAIL:

BY MAIL:

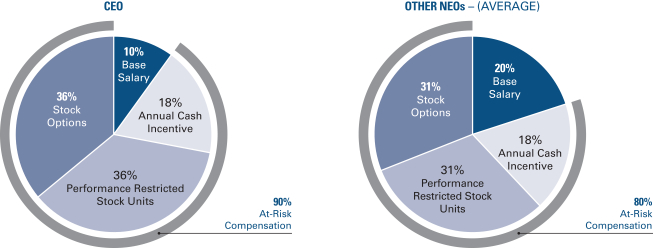

Annual “say-on-pay” advisory vote for shareholders (approved by 91.4% of votes cast in 2020)

Annual “say-on-pay” advisory vote for shareholders (approved by 91.4% of votes cast in 2020) No excise tax gross-up payments

No excise tax gross-up payments