VF CORPORATION

June 12, 2023

Dear Fellow Shareholders:

We are pleased to invite you to the 2023 Annual Meeting of Shareholders of VF Corporation, to be held Tuesday, July 25, 2023, live via the Internet at www.virtualshareholdermeeting.com/VFC2023, commencing at 10:30 a.m., Mountain Time. After careful consideration, our Board of Directors has determined to once again hold a virtual annual meeting in order to facilitate shareholder attendance and participation by enabling shareholders to participate from any location and at no cost. We believe this is the right choice for VF at this time, as it enables engagement with our shareholders, regardless of size, resources, or physical location. Shareholders will not be able to attend the meeting in person.

We are committed to ensuring that shareholders who attend the virtual meeting are afforded the same rights and opportunities to participate as they would at an in-person meeting, using online tools to ensure shareholder access and participation. To attend the meeting, shareholders must visit www.virtualshareholdermeeting.com/VFC2023 and enter their control number included on the Notice of Internet Availability of Proxy Materials (the “Notice”), on the proxy card, or on the instructions that accompany the proxy materials. To submit a question, shareholders must visit www.proxyvote.com, enter their control number, and follow the instructions to submit a question not later than 5:00 p.m., Eastern Time, on Friday, July 21, 2023.

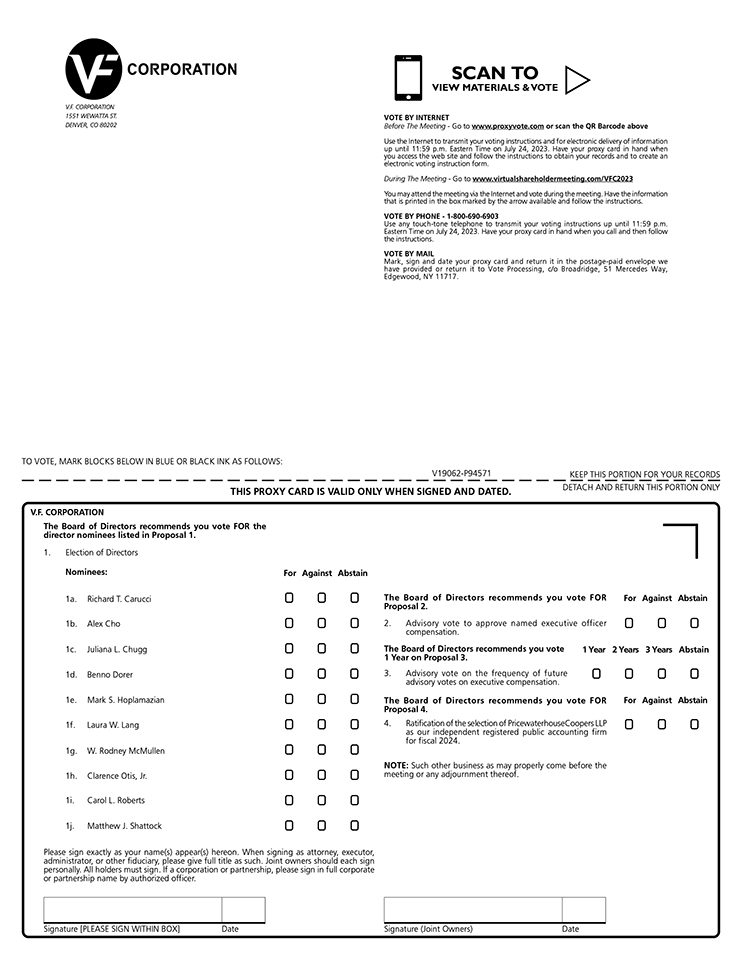

At the meeting, shareholders will be asked to vote on (i) the election of directors; (ii) approval of the compensation of named executive officers as disclosed in this proxy statement; (iii) the frequency of future advisory votes on executive compensation; (iv) ratification of the selection of PricewaterhouseCoopers LLP as VF’s independent registered public accounting firm for fiscal 2024; and (v) such other matters as may properly come before the meeting.

Your Board of Directors recommends a vote “FOR” the election of the persons nominated to serve as directors, “FOR” the approval of compensation of named executive officers as disclosed in this proxy statement, “ONE YEAR” on the frequency of future advisory votes on executive compensation, and “FOR” the ratification of the selection of PricewaterhouseCoopers LLP as VF’s independent registered public accounting firm. Regardless of the number of shares you own or whether you plan to attend the virtual meeting, it is important that your shares be represented and voted at the meeting.

On or about June 12, 2023, we will begin mailing the Notice to all shareholders of record on our books at the close of business on May 30, 2023, the record date for the meeting, and will post our proxy materials on the website referenced in the Notice. As more fully described in the Notice, shareholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail, or electronically by email, on an ongoing basis.

You may vote by attending the virtual meeting or you may vote your shares via the Internet, via a toll-free telephone number, or by signing, dating and mailing a completed proxy card, as explained in the “About the Meeting” section of the attached proxy statement.

Your interest and participation in the affairs of VF are most appreciated.

Sincerely,

Richard Carucci

Interim Chair of the Board

Annual

Annual  No excise tax

No excise tax

BY INTERNET:

BY INTERNET: BY TELEPHONE:

BY TELEPHONE: BY MAIL:

BY MAIL: